how to open tax file malaysia

Please complete this online registration form. How Can I Open Income Tax Account In Malaysia.

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

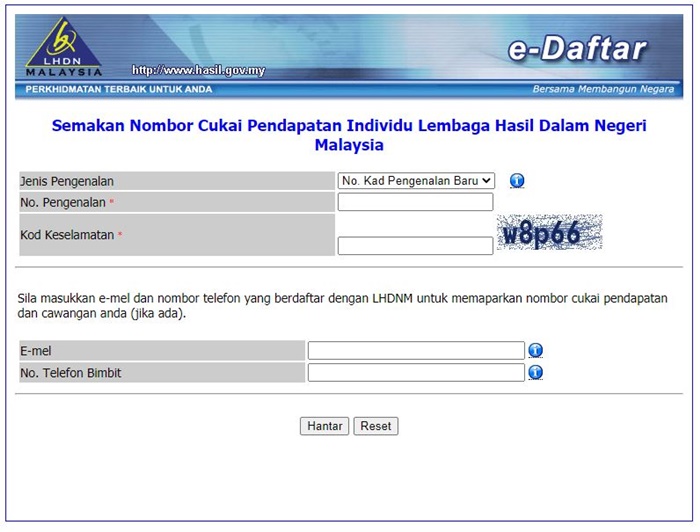

Click on e-Filing PIN Number Application on the left and then click on.

. Submit form CP204 within the first year. How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time. Scroll down until you see Muat Naik Disini where youll need to upload a copy of your Identity Card.

When you arrive at IRBs official website look for ezHASIL and click on it. This can be done at the nearest SSM office or via their online portal. Pay tax instalments if a profit is forecasted in the coming year.

22 Business registration certificate for Malaysian citizen who carries on business. Review all the information click Agree Submit button. Failure to do so can result in a 10 increment of the payable tax or a disciplinary fee.

Taxpayers are advised to submit their. Number can be seen clearly and the file must be in gif format. Online submissions of tax returns for 2021 will be accepted beginning March 1 the Inland Revenue Board LHDN said today.

How to File Income Tax in Malaysia Using e-Filing 1. Individual who has income which is taxable. Click on the e-Daftar icon or link.

Wait about two to three days for LHDN to process your application. Visit the official Inland Revenue Board of Malaysia website. The tax year in Malaysia runs from January 1st to December 31st.

Make sure your email address is correct because LHDN will send a reference number to your email. We have prepared a primer and a simplified step-by-step guide based on our own experiences to help you understand what you need to do and how to file your pe. You must be wondering how to start filing income tax for the.

Save your Tax Reference number. Login to e-filing website. A businessperson with taxable income.

An employee who is subject to monthly tax deduction. Settle all unpaid taxes within 7 months from the end of the companys financial year. Click on ezHASiL.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. Among the information that shall be updated are if any. Walk in to IRBM branch that handles your income tax file.

If you do not hold but require an Income Tax Number you should. Heres the process in brief for a new business. You just need to enter your income deduction relief and.

Make sure to scan the front so your name and IC. Go to e-filing website. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

A business or company which has employees and fulfilling the criteria of registering employer tax. The process is simple and wont take you more than two hours to complete. The following entities and accounting firms in Malaysia must file their taxes.

We highlight the personal income tax rate for foreigners and expats how to get your income tax number from Lembaga Hasil Dalam Negeri LHDN or the Inland Revenue Board of Malaysia and. Go through the instructions carefully. Passport number for non -Malaysian citizens Bank account name and number if applicable Marital status.

Obtaining an Income Tax Number. It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form because all the calculation is automatic. Go through the instructions carefully.

Click on the e. Record down your tax reference number. 21 Copy of Identity card for Malaysian Citizen permenant resident or passport for non Malaysian citizen.

Youll need to submit a completed Business Registration Form Form A along with a photocopy of your NRIC permit or supporting letters if any and the required payment. Fill up PIN Number and MyKad Number click Submit button. Click on e-Daftar.

All tax residents subject to taxation need to file a tax return before April 30th the following year. Business address if applicable Personal email address. Submit income tax return Form C within 7 months from the end of the companys financial year.

23 Passport and business registration certificate for non-citizen who. A video step-by-step guide to accompany our earlier post about how to file your personal income tax in Malaysia in 2019 as an expat or foreigner. You can save the page as a PDF by clicking Print This Page For Future Reference.

To complete a tax return expats need to fill out a Yearly Remuneration Statement EA. Register Online Through e-Daftar. Click on Permohonan or Application depending on your chosen language.

Browse to ezHASiL e-Filing website and click First Time Login. Income Tax Return Form ITRF ezHASil e-Filing is a most convenient way to submit Income Tax Return Form ITRF. Once you do this your e-Filing account digital certificate will be registered may proceed to complete the ITRF through ezHASiL e-Filing.

Unregistered companies with IRBM. The file size also must be between 40k and 60k and the file name must be in alphanumeric only. Once you have completed and uploaded the required documents click Submit and LHDN will provide a Pin Number for you to review the application after 7 working days.

In a statement it said the submission of tax return forms through e-filing for Forms E BE B M BT MT P TF and TP can be made through the official HASiL portal. Next key in your MyKad identification number without the. If youd like to retrieve it online head over to the LHDN Maklum Balas Pelanggan Customer Feedback website.

Please upload your application together with the following document. Fill in the required information. Once you have double-checked your details click Accept.

How To File Your Taxes For The First Time

How To File Your Taxes For The First Time

Nykaa Customer Care Number 900 7641 009 07477526839 24 7 Hours Availablenykaa Customer Care Numb Dr Car Customer Care Care

Study With Me Photo Journal Travel Journal Bullet Journal For Beginners

Filing Your Taxes For The First Time In Malaysia Read This First Ya 2021 Althr Blog

How To Register As A Taxpayer For The First Time In 2022

Difference Between Resident And Nri Fixed Deposit India Nri Saving And Investment Tips Savings And Investment Investment Tips Investing

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Filing Your Taxes For The First Time In Malaysia Read This First Ya 2021 Althr Blog

Malaysia Personal Income Tax Guide 2021 Ya 2020

Form 2290 E Filing For Tax Professionals Irs Forms Irs Employer Identification Number

Impacts Of Covid 19 On Firms In Malaysia Results From The 1st Round Of Covid 19 Business Pulse Survey

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Bursa Malaysia Logo Vector Cdr Vector Logo Malaysia Logo

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Pin By Uncle Lim On G Newspaper Ads Merry Christmas And Happy New Year Merry Christmas Happy New